30+ Car loan amortization schedule

Loan term in years - most fixed-rate home loans across the United States are scheduled to amortize over 30 years. Thats an awful place to be because even if you sell the car tomorrow you.

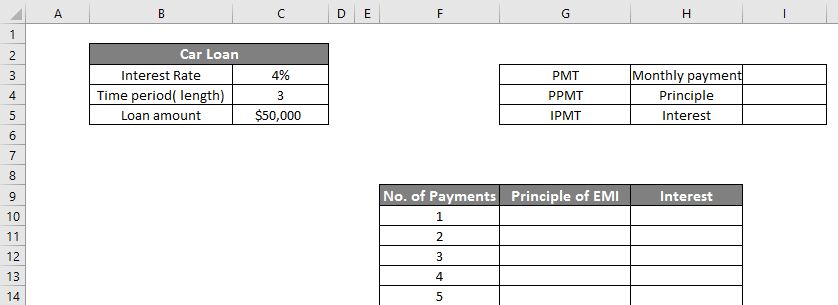

Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then.

. For a 30-year loan at 6 you would set r 006 n 30 and p 1 to calculate the annual payment. Showing how each loan is amortized in real-time. The longer you take to pay off your auto loan the higher the likelihood that your car will go underwater or upside down meaning you owe more on the loan than the car is worth also known as negative equity.

Car amortization schedule uses inputs like down payment amount loan term and interest rate to help identify exactly what your car payments are or will be. Enter loan amount interest rate number of payments and payment frequency to calculate financial loan amortization schedules. Normally Credit card and Car Loans interest are higher than a mortgage loan.

Baca Juga

Amortization is the process of breaking the loan into equal monthly payments. Lets look at the example of the loan amortization schedule of the above example for the first six months. Student Loan Calculator is used to calculate monthly payments for your student loan.

Other common domestic loan periods include 10 15 20 years. See how those payments break down over your loan term with our amortization calculator. For car loans this time ranges from 3-5 years.

Most people dont keep the same home loan for 15 or 30 years. Type the loan amount into the Loan Amount cell. The repayment will be made in monthly installments.

A person could use the same spreadsheet to calculate weekly biweekly or monthly payments on a shorter duration personal or auto loan. As mentioned the title loan calculator provides more than just a payment estimate. Car loan amortization calculator harnesses all the factors influencing borrowing and repaying car loans distilling your loans payment amount at various intervals.

To type it just click the existing value 5000 and type your own amount. Understanding a Loan Amortization Calculator. This example teaches you how to create a loan amortization schedule in Excel.

You can use a loan amortization calculator to spell out payments using a loan amortization schedule which shows how much interest and principal you. Loan amortization is the process of scheduling out a fixed-rate loan into equal payments. Its in the ENTER VALUES section near the top-left corner of the sheet.

Brets mortgageloan amortization schedule calculator. Some of Our Software Innovation Awards. This allows you to see each monthly payment broken out into both principal and interest.

Whether you are buying an used car or finance for a new car you will find this auto loan calculator come in handy. How To Pay Your Car Loan Off Fast. Here we are going to build out an amortization schedule for a loan and its going to be one of those exercises like in high school where your teacher made you do it by hand yet the entire time you were probably thinking this would be much easier with a calculator.

It also computes the entire re-payment schedule. With ARMs the lender can adjust the rate on a predetermined schedule which would impact your amortization schedule. Amortization Schedule with Extra Payments.

Calculate loan payment payoff time balloon interest rate even negative amortizations. A portion of each installment covers interest and the remaining portion goes toward the loan principal. Select the range A8E8 second payment and drag it down to row 30.

See how the principal part increases and the interest part decreases with each payment. The amount due is 14000 USD at a 6 annual interest rate and two years payment period. The mortgage amortization schedule shows how much in principal and interest is paid over time.

Create an amortization schedule for fixed-principle declining-interest loan payments where the principal remains constant while the interest and total payment amounts decrease. These are often 15- or 30-year fixed-rate mortgages which have a fixed amortization schedule but there are also adjustable-rate mortgages ARMs. So pay them at first before paying off your mortgage loan.

For these types of loans if you create an amortization schedule using the technique described above the schedule would need to show yearly payments even though payments may actually be paid monthly or biweekly. Other common domestic loan periods include 10 15 20 years. Since its founding in 2007 our website has been recognized by 10000s of other websites.

My Excel template Amortization schedule with irregular payments. By default this calculator is selected for monthly payments and a 30-year loan term. It takes 24 months to pay off this loan.

An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan. By making extra payments on a regular basis or a large one-time lump sum payment toward principal may save a borrower thousands of dollars in interest payments and may even cut a few years of the loan terms depending on the size of. Learn more about financial functions.

The student loan amortization schedule excel will show you the principal interest remaining balance of each and every payment and is exportable as an excel spreadsheet. Extra payments allow borrowers to pay off their home mortgages or personal loans faster. Almost any data field on this form may be calculated.

This time ranges from 15 to 30 years. Car loan calculator with amortization schedule and extra payments to calculate the monthly payment and generates a car loan amortization schedule excel.

10 Loan Calculator Templates In Pdf Doc Free Premium Templates

Excel Pmt Function With Formula Examples

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

How Do Car Loans Work A Complete Beginners Guide Carclarity

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Homewise Review Loans Canada

Is 28 A Reasonable Apr For A Car Loan That S The Best I Ve Been Offered On A Used Car Worth 15k For A 72 Month Loan Quora

Personal Loan Interest Rates

Best 10 Loan Calculator Apps Last Updated September 6 2022

A Loan Of 15 Lacs At 10 Compound Interest Vs Same Amount At 14 Simple Interest Which One Is Better For A Repayment Period Of Ten Years Quora

Best 10 Loan Calculator Apps Last Updated September 6 2022

How To Get A Car Loan Without A Co Signer Recommended

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Excel Mortgage Calculator How To Calculate Loan Payments In Excel