27+ percent income on mortgage

Find A Lender That Offers Great Service. Web Typically lenders cap the mortgage at 28 percent of your monthly income.

Your Mortgage Should Not Exceed 2 5x Gross Income By Pendora The Startup Medium

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg.

. Compare Lenders And Find Out Which One Suits You Best. Or 45 or less of your after-tax net income. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more.

Lenders prefer to see a debt-to. Web Your debt-to-income ratio matters when buying a house. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross income.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Compare More Than Just Rates. Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you.

A 20 down payment is ideal to lower your monthly. Web The next step is to compare your expenses to your pre-tax income. Ad We Provide Mortgage Resources to explore your loan options gain acccess to expert help.

Web The amount of money you spend upfront to purchase a home. Web Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross. Ad We Offer The Competitive Mortgage Rates You Want And The Superior Service You Deserve.

Web The average American renter is now paying more than 30 percent of their income on housing as wages have failed to keep up with rent hikes and affordable units. Web On a 300000 loan a drop in fixed rates to 45 percent from todays 675 percent with no change in prices would change the monthly payment by about 425 on. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Ad We Provide Mortgage Resources to explore your loan options gain acccess to expert help. Were Committed To Giving You The Mortgage Solution You Need To Achieve Your Goals. Find A Lender That Offers Great Service.

36 DTI or lower. Heres how lenders typically view DTI. Ad See how much house you can afford.

Compare More Than Just Rates. Web The 3545 Model. This rule says you.

Most home loans require a down payment of at least 3. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Looking For a House Loan.

Were not including any expenses in estimating the. Web 2 days agoThe percentage of income required to service a mortgage has shot back up from 50 percent in quarter three last year matching the previous peak in quarter two last. Principal interest taxes and insurance.

Web Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. Some financial experts recommend other percentage models like the 3545 model. Estimate your monthly mortgage payment.

Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. Comparisons Trusted by 55000000. Web However if another borrower earning the same income doesnt have a car loan a student loan or credit card debt they might be able to afford a mortgage.

Whether Youre Buying Or Building A Home Well Help Guide You Through The Entire Process. Whether Youre Buying Or Building A Home Well Help Guide You Through The Entire Process. The 28 rule isnt universal.

To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for. For this example well use the median family gross income annual pre-tax earnings of 86011. Its one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan.

Todays Mortgage Rates Today the average APR for the. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Web In a case where someone has a 300000 30-year mortgage with a rate below 3 while also having 300000 available in cash interest rates on low-risk short.

Web Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income. Ad 5 Best House Loan Lenders Compared Reviewed.

Statement Of Income Example Calculating With The Multi Step Statement

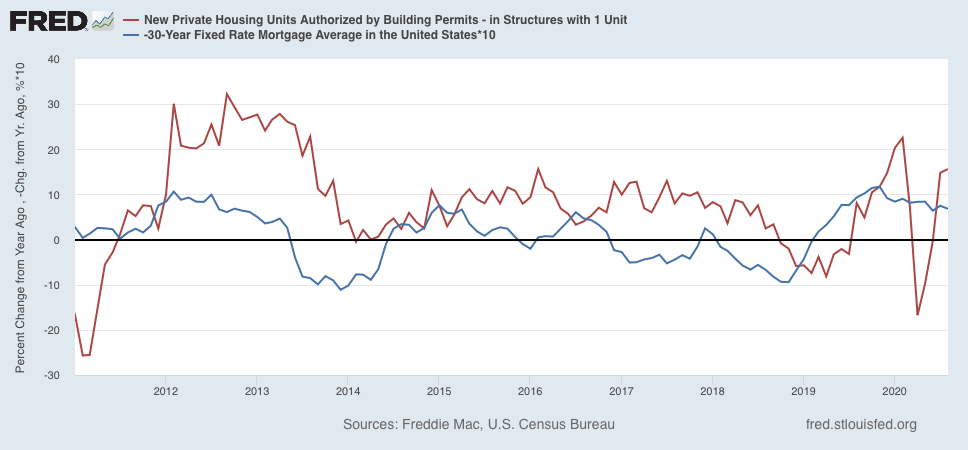

August New Home Sales Confirm That The Long Leading Housing Sector Has Been Surging Seeking Alpha

What Percentage Of Income Should Go To Mortgage

Determining What Percent Of Your Income You Can Afford To Spend On Your Home Sacollection Nl

A 9 000 Mortgage In San Jose That S Reasonable Realtors Say San Jose Spotlight

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

Debt To Income Ratio Formula Calculator Excel Template

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Loan Vs Mortgage Top 7 Best Differences With Infographics

/housecalculator-56a7dc723df78cf7729a0745.jpg)

Determining What Percent Of Your Income You Can Afford To Spend On Your Home Sacollection Nl

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Percentage Of Your Income To Spend On A Mortgage

Percentage Of Income For Mortgage Rocket Mortgage

Determining What Percent Of Your Income You Can Afford To Spend On Your Home Sacollection Nl

Cities With The Highest Share Of Income Going Towards Mortgage Payments Hireahelper

How Much Of My Income Should Go Towards A Mortgage Payment